The investment banking market has long been the financial powerhouse behind global economic development. From managing multi-billion-dollar mergers and acquisitions to underwriting IPOs and facilitating large-scale corporate financing, investment banks play a pivotal role in the capital markets ecosystem.

In recent years, this highly specialized sector has faced dramatic transformation due to the convergence of technology, regulatory shifts, and evolving client expectations. As financial institutions become increasingly digitized and data-driven, the investment banking market is adapting—balancing tradition with innovation.

Among the emerging themes across the financial industry is the growing concern for cybersecurity, prompting institutions to seek coverage from the cyber insurance market to mitigate the risks of digital operations. This trend reflects the growing interdependence of banking and technology in modern finance.

What Is the Investment Banking Market?

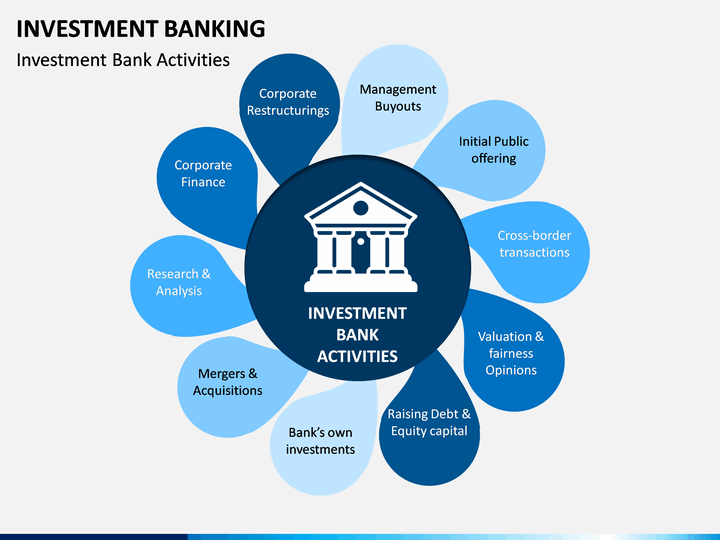

Investment banking refers to the segment of banking operations that helps individuals, corporations, and governments raise capital. It involves complex financial services, including:

Equity and debt underwriting

Mergers and acquisitions (M&A) advisory

Trading of derivatives, currencies, and securities

Financial restructuring and risk management

Asset management for institutional clients

Top players in this market include global firms like Goldman Sachs, JPMorgan Chase, Morgan Stanley, Barclays, and Citigroup. These firms operate in a high-stakes environment, where innovation, confidentiality, and strategic expertise are critical.

Key Trends Reshaping the Investment Banking Market

1. Digital Transformation and Fintech Integration

The infusion of fintech in investment banking is reshaping traditional workflows. Automated trading systems, blockchain for clearing and settlement, and data analytics tools are now integral to decision-making processes.

2. Increased Regulatory Compliance

Post-2008 financial crisis, investment banks operate under stricter compliance frameworks. Regulations such as Basel III, MiFID II, and Dodd-Frank have influenced risk exposure, leverage, and transparency.

3. Rise of ESG Investing and Sustainable Finance

Environmental, Social, and Governance (ESG) factors are becoming essential in deal-making and advisory services. Investment banks now conduct ESG risk assessments and develop green finance products.

4. Cybersecurity Risks and Digital Infrastructure

With digitization comes increased vulnerability. Investment banks handle large volumes of sensitive data and execute high-value transactions. To protect client and institutional data, firms are investing in advanced cybersecurity measures. The cyber insurance market has become a vital component in risk management strategies for these institutions.

5. Globalization and Emerging Markets

Investment banking is expanding rapidly in Asia-Pacific, the Middle East, and Latin America. These regions offer new investment opportunities, but also bring exposure to geopolitical, regulatory, and cyber risks.

Role of Technology in Investment Banking

Technology is now central to investment banking operations. Some key tech-driven areas include:

Artificial Intelligence & Machine Learning: Used for predictive modeling, customer insights, and fraud detection.

Blockchain: Enhances transparency and speed in trade settlements and smart contracts.

Cloud Computing: Offers scalable infrastructure for data storage, analytics, and collaboration.

Big Data Analytics: Helps in managing large datasets for investment research and strategy planning.

APIs and Open Banking: Facilitates integration with third-party platforms and real-time data sharing.

As firms become increasingly reliant on technology, their exposure to cyber threats has also increased. This has led to growing engagement with the cyber insurance market to ensure operational resilience.

Challenges Facing the Investment Banking Market

Despite its growth, the investment banking market faces several headwinds:

Intense Competition from Boutique Firms: Specialized advisory firms are carving a niche, especially in M&A and restructuring.

Talent Retention: Attracting and retaining skilled professionals is increasingly difficult due to demanding work culture and changing career preferences.

Macroeconomic Uncertainty: Interest rate fluctuations, inflation, and global conflicts affect capital flows and deal pipelines.

Cyber Threats: Phishing, ransomware, and insider threats pose serious risks to financial operations and reputations.

Firms are turning to proactive risk management and cyber insurance market policies to address these challenges.

Investment Banking and the Cyber Insurance Market

The convergence of investment banking and technology means that cyberattacks could result in multi-million-dollar losses, regulatory fines, and reputational damage. Investment banks often serve as critical financial infrastructure and are thus prime targets for cybercriminals.

The cyber insurance market provides financial protection against such events, covering data breaches, business interruption, regulatory penalties, and recovery costs. As cyberattacks grow more sophisticated, investment banks are working with insurers to craft policies tailored to their unique risk profiles.

This relationship is evolving from reactive to proactive, with insurers and banks collaborating on:

Vulnerability assessments

Penetration testing

Employee training and awareness programs

Real-time threat monitoring and response strategies

Outlook for the Investment Banking Market

Looking ahead, the investment banking market is expected to experience sustained growth, driven by factors such as:

Recovery in IPO activity and M&A deals

Increased cross-border investments

Expansion of digital and sustainable finance solutions

Greater collaboration with fintech and regtech providers

Enhanced cybersecurity measures supported by the cyber insurance market

According to market forecasts, the global investment banking revenue is projected to grow steadily over the next five years, fueled by both traditional services and emerging digital opportunities.

Conclusion

The investment banking market is at a pivotal point in its evolution. While core advisory and capital-raising services remain vital, the industry is undergoing a technological renaissance that promises greater efficiency, reach, and innovation.

As firms invest in digital platforms, data analytics, and AI, they must also safeguard their digital assets and client trust. The growing reliance on the cyber insurance market underscores the need for a comprehensive approach to risk management in today’s cyber-vulnerable world.

The future of investment banking lies in a balanced blend of cutting-edge technology, strategic advisory, and robust digital security—ensuring that global finance continues to thrive in a fast-paced, interconnected economy.

Related Trending Reports

| Public Cloud Market |

| Smart City Market |

| Kids Smartwatch Market |

| Building Automation System Market |

| Internet of Things (IoT) Cloud Platform Market |